Hence why trade-war onslaught started this month of March 2018 with steel and aluminium tariffs imposed under order of demagogue leader of the so called "free world" President Donald; and yesterday he further announced tariffs on $60 billion value of Chinese imports - its official its war! China retaliated with tit-for-tat action of imposing tariffs on only $3 billion on American imports, as reported by CNBC in the link provided above.

While officially an economic war, at the same said President of the United States of America or USA, announced the biggest ever increase to its military spending. Up US$80 billion to approximately US$700 billion on military spending; or expressed as a proportion of the total spending approved in the Senate in the early hours of Friday, 54% of the total US$1,300 billion expenditure in 2018/19 will be on the industrial military complex.

Of the US$1.3 trillion spending bill passed exigently early Friday, there are some reading between the lines, other than the obvious.

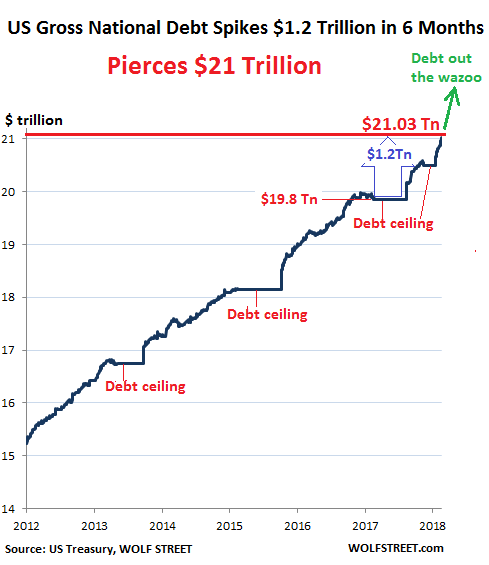

First of all this bill is also the raising of the "budget ceiling" i.e. how much spending the USA government fiscal deficit will sustain in a given year. As things stand the budget ceiling has today been raised 4 times int total in recent years (as WolfStreet.Com explains here), to avert what has been dramatically described as "government shutdown". So this current raising of the deficit "legislation would fund the government through the end of September". As for thereafter in this unique American legislation designed to ensure fiscal-budget prudence, anyones guess, or great uncertainty.

Remember that earlier this year the national debt of the USA passed the US$21 trillion mark (also described in the WolfStreet article referenced above, and shown in the chart below). This is less significant as a absolute number, with the Dollar as the reserve token currency allowing unprecedented increase in "money printing" (to make historical Weimar Republic period of hyperinflation look restrained), but reflected as percent of GDP or what America produces, the debt is very unsustainable.

Also as a consequence of the unsustainable ballooning debt-bubble of government, Trump is perhaps leading us to that one major dire and disastrous outcome - debt default. The caveat is, only if his "America First" protectionism does not lead to sustained growth. But as we have seen over the last 10 years of kicking the debt-calamity into the long-grass, since the credit bubble in financial services, there are other remedies than debt default and debt-destroying inflation; namely near-zero or zero interest rate policy - Z.I.R.P and debt restructuring (the bad debts racked-up by financial services are now American taxpayers debt burden through T.A.R.P and Q.E etc). Who should continue to revolt or cause civil disorder with rage, after sucessive US administrations and policies delivered austerity instead of prosperity for the masses.

This is why China is THE concerning crucial factor in the economic globalisation that we have seen accelerated since the 1980s or last 40 years. Trend of globalisation stopping now is evident, for fear that China grabs the economic growth that is needed in the current G7 countries, to pay-off their debt.

Yet the economic growth solution is hampered in the face climate change concerns. Yes climate change is only too REAL and beginning to be evident as an imminent threat to humanity and the planet. As are economic-growth threat from disruptive technologies that are burgeoning through to destroy traditional trading activities (e.g. shop-front buying and selling versus Internet online markets). Another example of the titans at

trade war: China's scale of production has massively reduced the price of solar panels as an alternative to expensive fossil-fuel based oil and gas.

What of the disruption (which is a euphemistic term) to traditional oil and gas exploration extracting refining and distribution industries, from climate-change concerns? The write-down or destruction of these industries' assets, whose stock market values reflect status quo international free-trade policies, will not be merely disruptive! We have seen this month the stock market valuations impact on global steel and aluminium companies.

See the latest research from the CarbonTracker.Org initiative (which investment bank research will not show!): Mind The Gap: $1.6 trillion energy transition risk.

Finally, in the context of what we have discussed above there will begin as covert of subterfuge psychological operations towards a cultural revolution. "America First", mentioned earlier is only the same socio-economic political stance as once great empire hegemony of United Kingdom, who exited the regional union of group known as European Union (which had as it early phase / guise the E.E.C - the European Economic Cooperation), on June 23rd 2016. Now this great tear-away from globalisation via regionalisation, project is named simply "Brexit". Abbreviation for for Britain Exits the European Union.

The cultural revolution in countries will also be "twitching" by the masses of people away from traditional government by politicians, viz. billionaire Trump as President of the USA and Andrej Babis in Czech Republic. Political machinery, which after 40 years of liberal capitalism, a period better known as "neoliberalism", has produced the rise and decline of the middle class, while creating and enriching plutocrats and oligarchs. As represented by billionaire wealth status of the top 1% of global population. Those politicians are dubbed by Fund Portfolio Management's own reputation thesis, NoSmokeWithoutFire, hastag #politiciansRcriminals.

The cultural revolution will also take the form of behavioural changes, as led from not only disruptive industries (whether people like or accept the phenomena that we are put-through for corporations, who define and rule via Pavalov's dogs impulses, most of our lifestyles behaviours), but from controls about freedom of movement of people, and indeed movement of goods. Which in context of free-trade developments THIS month, is supportive of Fund Portfolio management's geopolitical-tension scenario in the near- to medium-term.

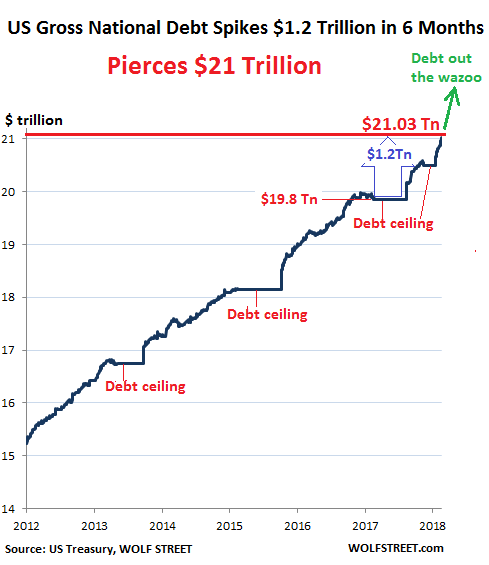

In short any activities which all add to greater carbon emission, and destruction of the planet will be curtailed. As evidence look at the slow economic growth of the last 10 years imposing mass austerity on the many under neoliberalism. That was not by accident, it was by design, in the face of the most important chart to mankind (by kind permission of Nasa below citing all the evidence. Don't take FPM's word for it.

![This graph, based on the comparison of atmospheric samples contained in ice cores and more recent direct measurements, provides evidence that atmospheric CO2 has increased since the Industrial Revolution. (Source: [[LINK||http://www.ncdc.noaa.gov/paleo/icecore/||NOAA]])](https://climate.nasa.gov/system/content_pages/main_images/203_co2-graph-021116.jpeg)

First of all this bill is also the raising of the "budget ceiling" i.e. how much spending the USA government fiscal deficit will sustain in a given year. As things stand the budget ceiling has today been raised 4 times int total in recent years (as WolfStreet.Com explains here), to avert what has been dramatically described as "government shutdown". So this current raising of the deficit "legislation would fund the government through the end of September". As for thereafter in this unique American legislation designed to ensure fiscal-budget prudence, anyones guess, or great uncertainty.

Remember that earlier this year the national debt of the USA passed the US$21 trillion mark (also described in the WolfStreet article referenced above, and shown in the chart below). This is less significant as a absolute number, with the Dollar as the reserve token currency allowing unprecedented increase in "money printing" (to make historical Weimar Republic period of hyperinflation look restrained), but reflected as percent of GDP or what America produces, the debt is very unsustainable.

Also as a consequence of the unsustainable ballooning debt-bubble of government, Trump is perhaps leading us to that one major dire and disastrous outcome - debt default. The caveat is, only if his "America First" protectionism does not lead to sustained growth. But as we have seen over the last 10 years of kicking the debt-calamity into the long-grass, since the credit bubble in financial services, there are other remedies than debt default and debt-destroying inflation; namely near-zero or zero interest rate policy - Z.I.R.P and debt restructuring (the bad debts racked-up by financial services are now American taxpayers debt burden through T.A.R.P and Q.E etc). Who should continue to revolt or cause civil disorder with rage, after sucessive US administrations and policies delivered austerity instead of prosperity for the masses.

This is why China is THE concerning crucial factor in the economic globalisation that we have seen accelerated since the 1980s or last 40 years. Trend of globalisation stopping now is evident, for fear that China grabs the economic growth that is needed in the current G7 countries, to pay-off their debt.

Yet the economic growth solution is hampered in the face climate change concerns. Yes climate change is only too REAL and beginning to be evident as an imminent threat to humanity and the planet. As are economic-growth threat from disruptive technologies that are burgeoning through to destroy traditional trading activities (e.g. shop-front buying and selling versus Internet online markets). Another example of the titans at

trade war: China's scale of production has massively reduced the price of solar panels as an alternative to expensive fossil-fuel based oil and gas.

What of the disruption (which is a euphemistic term) to traditional oil and gas exploration extracting refining and distribution industries, from climate-change concerns? The write-down or destruction of these industries' assets, whose stock market values reflect status quo international free-trade policies, will not be merely disruptive! We have seen this month the stock market valuations impact on global steel and aluminium companies.

See the latest research from the CarbonTracker.Org initiative (which investment bank research will not show!): Mind The Gap: $1.6 trillion energy transition risk.

Finally, in the context of what we have discussed above there will begin as covert of subterfuge psychological operations towards a cultural revolution. "America First", mentioned earlier is only the same socio-economic political stance as once great empire hegemony of United Kingdom, who exited the regional union of group known as European Union (which had as it early phase / guise the E.E.C - the European Economic Cooperation), on June 23rd 2016. Now this great tear-away from globalisation via regionalisation, project is named simply "Brexit". Abbreviation for for Britain Exits the European Union.

The cultural revolution in countries will also be "twitching" by the masses of people away from traditional government by politicians, viz. billionaire Trump as President of the USA and Andrej Babis in Czech Republic. Political machinery, which after 40 years of liberal capitalism, a period better known as "neoliberalism", has produced the rise and decline of the middle class, while creating and enriching plutocrats and oligarchs. As represented by billionaire wealth status of the top 1% of global population. Those politicians are dubbed by Fund Portfolio Management's own reputation thesis, NoSmokeWithoutFire, hastag #politiciansRcriminals.

The cultural revolution will also take the form of behavioural changes, as led from not only disruptive industries (whether people like or accept the phenomena that we are put-through for corporations, who define and rule via Pavalov's dogs impulses, most of our lifestyles behaviours), but from controls about freedom of movement of people, and indeed movement of goods. Which in context of free-trade developments THIS month, is supportive of Fund Portfolio management's geopolitical-tension scenario in the near- to medium-term.

In short any activities which all add to greater carbon emission, and destruction of the planet will be curtailed. As evidence look at the slow economic growth of the last 10 years imposing mass austerity on the many under neoliberalism. That was not by accident, it was by design, in the face of the most important chart to mankind (by kind permission of Nasa below citing all the evidence. Don't take FPM's word for it.

![This graph, based on the comparison of atmospheric samples contained in ice cores and more recent direct measurements, provides evidence that atmospheric CO2 has increased since the Industrial Revolution. (Source: [[LINK||http://www.ncdc.noaa.gov/paleo/icecore/||NOAA]])](https://climate.nasa.gov/system/content_pages/main_images/203_co2-graph-021116.jpeg)

No comments:

Post a Comment

FPM welcomes sensible feedback on our blogs / website. Through our work FPM is evolving from an asset advisory model to an asset management proposition.